ny paid family leave tax rate

The contribution remains at just over half of one percent of an employees gross wages each pay period. Part-time employees may be eligible for Paid Family Leave.

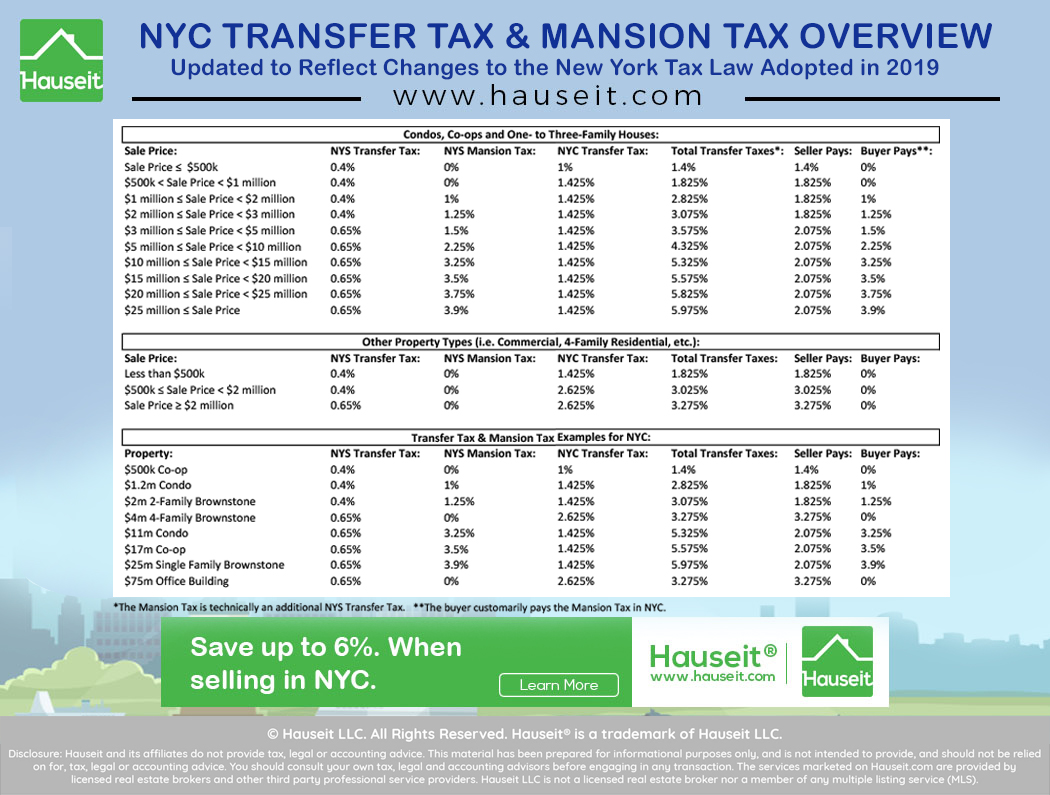

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

In 2020 eligible employees can receive 60 of their average weekly wage AWW up to a maximum of 84070 per week for up to 10 weeks under NYS PFL.

. In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 145017. Assist loved ones when a spouse domestic partner child or parent is deployed abroad on active military service. Paid Family Leave provides eligible employees job-protected paid time off to.

On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No. Employee-paid premiums should be deducted post-tax not pre-tax. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld.

NEW YORK PAID FAMILY LEAVE 2018 vs. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020.

Would an employers experience rate increase in the next year if an employee uses the Paid Family Leave program. Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. Employer Facts Effective January 1 2018 nearly all private employers in New York State must secure Paid Family Leave coverage for their employees.

Contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of per employee per year. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. 2022 Paid Family Leave Payroll Deduction Calculator.

Duration maximum 10 weeks. Paid Family Leave coverage is funded by employee payroll contributions. For 2021 the contribution rate for Paid Family Leave will be 0511 of the employees weekly wage capped at the New York The maximum contribution will be 38534 per.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. In New Jersey go to Other Non-Wage IncomeYou will see a Description and Amount from your employers 1099-MISC. Employees earning less than the current Statewide Average Weekly Wage SAWW of.

The maximum weekly benefit for 2021 is 97161. An employers experience rate will not necessarily increase. Bond with a newly born adopted or fostered child Care for a family member with a serious health condition or.

What Is Ny Paid Family Leave Tax. Duration maximum 12 weeks. Download about PFL At-A-Glance PDF Reports NYS Paid Family Leave Arbitration 2021 Q2 Report PDF Review of denials and other claim-related Paid Family Leave PFL disputes are handled by.

In 2020 these deductions are capped at the annual maximum of 19672. 2022 Paid Family Leave Rate Increase. Paid Family Leave PFL is now available to eligible employees of the City of New York.

2020 Paid Family Leave Payroll Deduction Calculator. Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay period with a maximum annual contribution of 42371. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation.

2021 the Office of the State Comptroller issued State Agencies Bulletin No 1982 to inform agencies of the 2022 New York State Paid Family Leave Program rate. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current. There are various factors that can impact an experience rate such as overall benefits paid to former employees and whether contributions are paid timely.

Use the calculator below to view an estimate of your deduction. Up to the annualized New York State Average Weekly Wage. 1887 to inform agencies of the 2021 rate for the New York State Paid Family Leave Program.

Use the calculator below to view an estimate of your deduction. The maximum annual contribution for 2022 is 42371. The New York State Department of Financial Services recently announced that the 2019 premium rate and the maximum weekly employee contribution for coverage will be 153100 of an employees weekly wage up to the statewide AWW.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax March 15 2020 520 PM. You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. A brief outline of New York Paid Family Leave.

The Paid Family Leave wage replacement benefit is also increasing. Enter another line Non-taxable NY Paid Family Leave in the description and the same amount as a NEGATIVE. Effective January 1 2018 New York State enacted New York Paid Family Leave PFL one of the most comprehensive family leave programs in the nation.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0270 of your gross wages each pay period. The maximum 2021 annual contribution will be 38534 up from 19672 for 2020. Family Leave Insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes.

Employers should report employee contributions on IRS Form W-2 Box 14. Paid Family Leave may also be available. The premium rate also increased in 2020 and employers can deduct up to 027 of employees gross wages up to an annual cap of 19672 to fund NYS PFL insurance.

2021 NY PAID FAMILY LEAVE PREMIUM RATE INFORMATION. NYGOVPAID FAMILY LEAVE PAGE 1 OF 2 NEW YORK STATE PAID FAMILY LEAVE. NEW YORK PAID FAMILY LEAVE 2020 vs.

In 2022 these deductions are capped at the annual maximum of 42371. State disability insurance. Part-time employees who work a regular schedule of less than 20 hours per week for a covered employer are eligible to take Paid Family Leave after working 175 days for their employer which do not need to be consecutive unless they qualify for and have executed a waiver.

The premiums will be post-tax which means deducted from an employees after-tax wages. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions.

How Do State And Local Sales Taxes Work Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

What Is A Homestead Exemption And How Does It Work Lendingtree

2022 Federal State Payroll Tax Rates For Employers

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

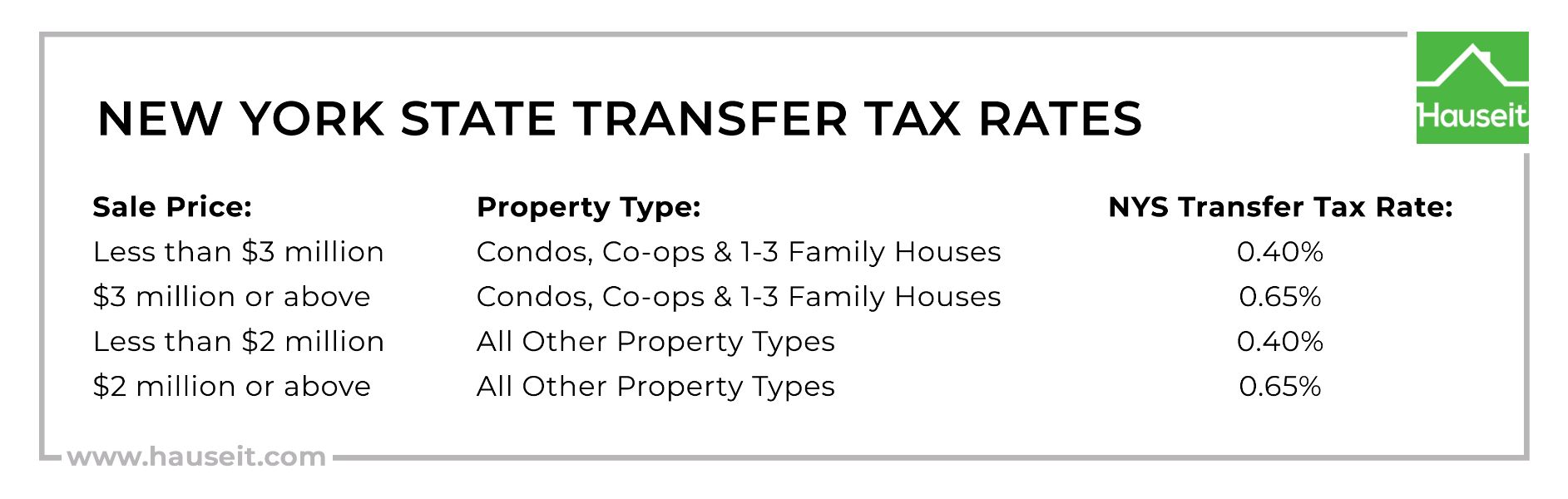

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

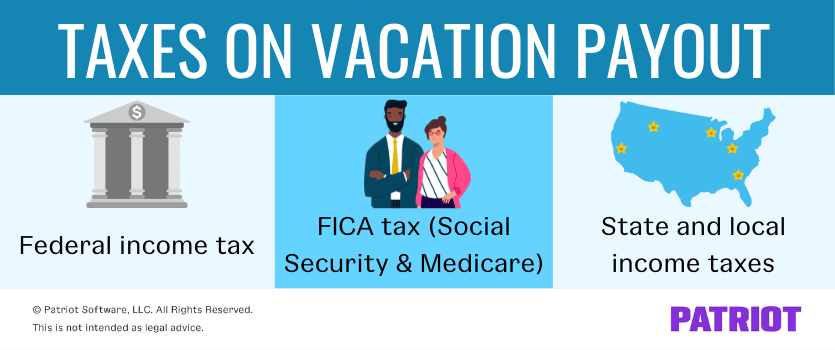

Taxes On Vacation Payout Tax Rates How To Calculate More

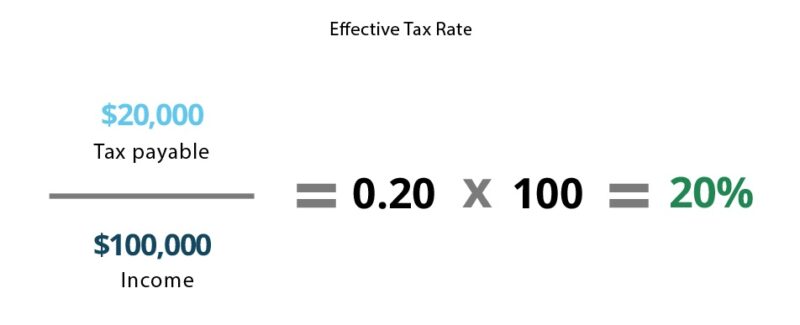

Marginal Tax Rate Formula Definition Investinganswers

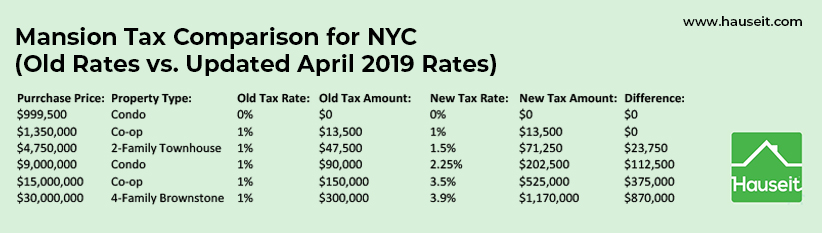

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation